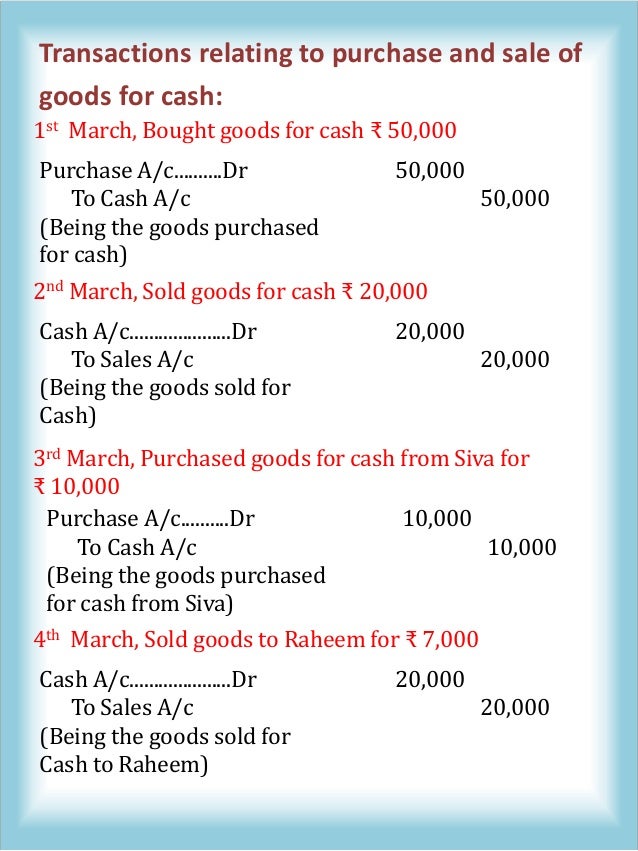

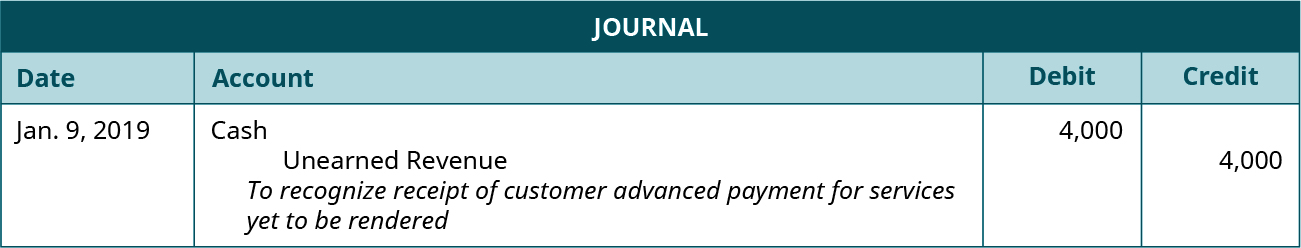

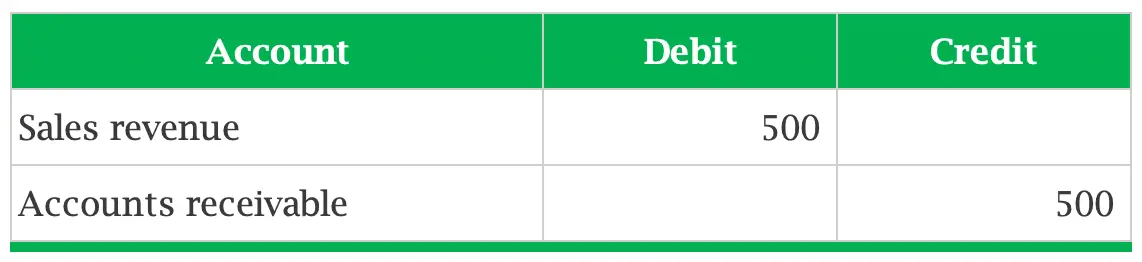

You also list the total amount due from the invoice as a credit in the sales account. For the journal entry, you can document the total amount due from the invoice as a debit in the accounts receivable account. When you send an invoice to a customer, you enter it as a journal entry to the accounting journal. A journal entry may contain:Ī journal entry number or reference number for the entry Invoices include information regarding the sale of the products or services, such as a description of the product or service, the total cost and the payment due date. It stores this in a journal to keep the financial records organized, which is crucial to the successful management of the business.Ĭompanies use invoices to report accounts receivable transactions.

What is a journal entry for accounts receivable?Ī journal entry for accounts receivable is a company's written report of every financial transaction.

#DUE TO DUE FROM JOURNAL ENTRIES EXAMPLES HOW TO#

In this article, we discuss what journal entries for accounts receivable are, why they're important and how to create a journal entry for accounts receivable.

Understanding journal entries for accounts receivable can help you keep accurate and complete records for an organization and improve your financial qualifications.

A company records these financial transactions through accounts receivable journal entries to help them track their finances more effectively. Accounts receivable is the amount of money a customer owes a company in exchange for products or services.

0 kommentar(er)

0 kommentar(er)